Ghana faces escalating revenue losses due to systemic tax leakages and inefficiencies. Experts at the recent National Dialogue emphasized the urgent need for technology-driven reforms to enhance tax collection and broaden the tax base.

Background

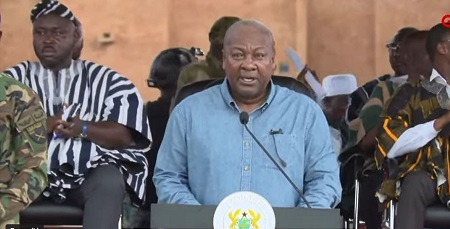

At the National Dialogue on “Tackling Tax Revenue Leakages in Ghana,” held on April 23, 2025, stakeholders from academia, industry, and government convened to address the persistent challenges in Ghana’s tax system. The consensus was clear: without significant reforms, Ghana risks continued revenue shortfalls that could hinder national development efforts.

Expert Insights

Abigail Maame Esi Mensah, Manager of Business Tax Advisory at Ernst & Young, highlighted the challenges posed by the informal economy. She noted that the lack of an integrated tax system makes it difficult to incorporate informal sector actors into the tax net. Additionally, she pointed out that practices like related-party transactions and transfer mispricing among large firms further erode the tax base.

Dr. Priscilla Twumasi Baffuor, Senior Lecturer at the University of Ghana’s Department of Economics, emphasized the transformative potential of technology in tax administration. She stated, “Technology has been a game-changer, but we are only scratching the surface.” Dr. Twumasi advocated for reducing human interactions in tax processes to minimize opportunities for corruption and improve transparency.

Dr. Richard Boso, a specialist in mining governance at the Kwame Nkrumah University of Science and Technology (KNUST), discussed cultural factors that undermine the tax system’s integrity. He pointed out that a misplaced sense of community often leads to corruption, emphasizing the need for systemic changes to address these deep-rooted issues.

The Role of Technology

The integration of the Ghana Card with the Tax Identification Number (TIN) was identified as a positive step towards building a more inclusive and effective tax system. However, experts agreed that more comprehensive technological solutions are necessary. Implementing digital platforms can streamline tax collection, reduce administrative costs, and enhance compliance.

Policy Recommendations

To address the identified challenges, experts recommended:

- Expanding Digital Infrastructure: Invest in robust digital systems to facilitate efficient tax collection and monitoring.

- Formalizing the Informal Sector: Develop strategies to integrate informal businesses into the formal economy, thereby broadening the tax base.

- Enhancing Transparency: Utilize technology to reduce human interactions in tax processes, minimizing opportunities for corruption.

- Continuous Stakeholder Engagement: Foster collaboration among government agencies, private sector, and civil society to ensure inclusive policy development and implementation.

Implications

Without immediate and effective reforms, Ghana risks exacerbating its revenue losses, which could impede critical public services and infrastructure development. Embracing technology-driven solutions is not just an option but a necessity to safeguard the nation’s fiscal health.

Be the first to leave a comment